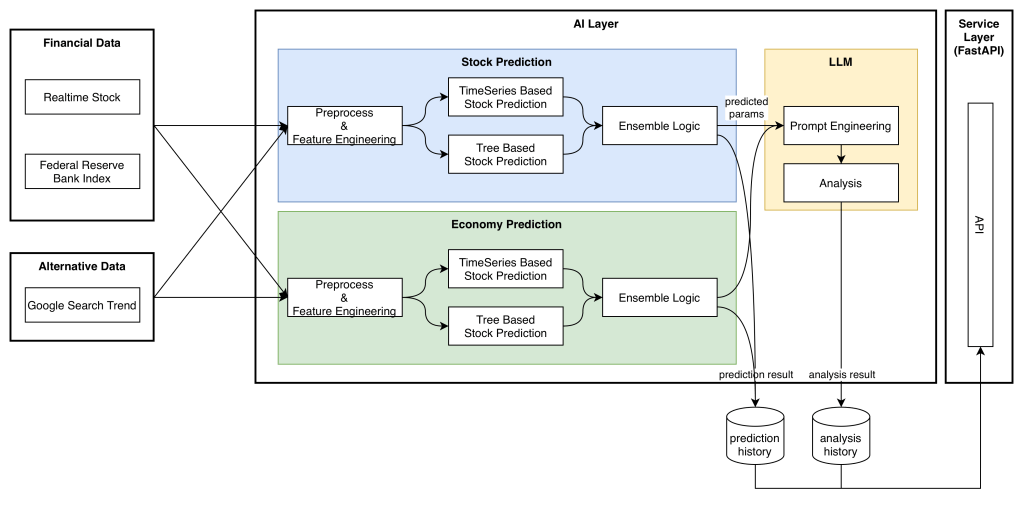

This project is an experimental platform designed to help investors make informed, data-driven decisions by combining long-term financial modeling with real-time market intelligence. The solution consists of two core components

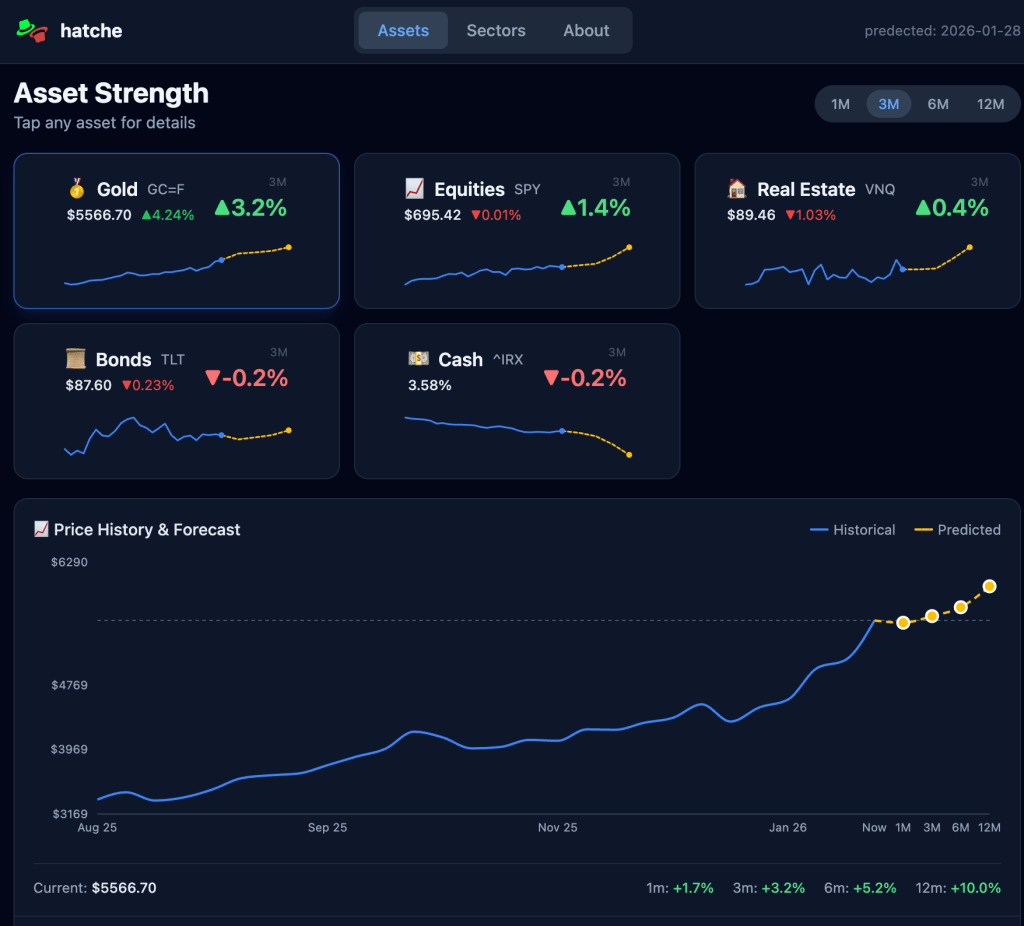

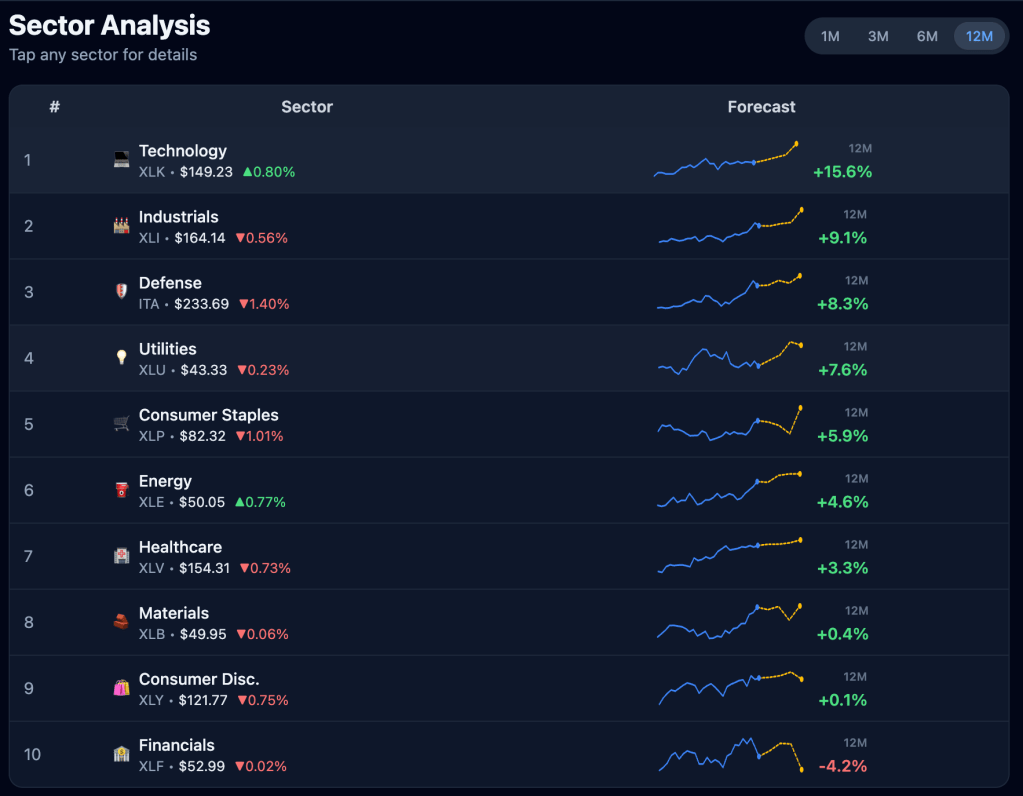

AI-Driven Prediction Engine – A multi-asset forecasting system covering 5 asset classes (Equities, Gold, Bonds, Real Estate, Cash) and major equity sectors (Technology, Healthcare, Financials, Energy, etc.). The engine uses:

- Ensemble Learning – time series and tree based machine learning models are combined with optimized weighting based on validation performance

- Asset-Specific Feature Engineering – Customized technical indicators, macro signals (Fed Funds, yield curves, inflation expectations), and cross-asset correlations tailored to each asset’s behavior

- Alternative Data Integration – Google Trends search volume data (“buy gold”, “inflation”, etc.) as sentiment indicators and retail attention proxies

- Adaptive Signal Logic – Momentum-based probability adjustments that recognize strong trend persistence, preventing false mean-reversion signals during sustained rallies

- Multi-Horizon Forecasting – Predictions for 1-month, 3-month, 6-month, and 12-month horizons with directional signals (BULL/HOLD/BEAR) and probability scores

Real-time pricing is fetched via Yahoo Finance API to ensure predictions remain aligned with current market conditions.

Interactive Analytics Platform – A full-stack React + Firebase application enabling users to:

- Explore Predictions – View ranked asset recommendations with expandable detail cards showing price targets and return forecasts

- Visualize Trends – Interactive sparkline charts (collapsed view) and detailed historical + predicted price charts (expanded view) distinguishing past data (solid lines) from future projections (dashed lines)

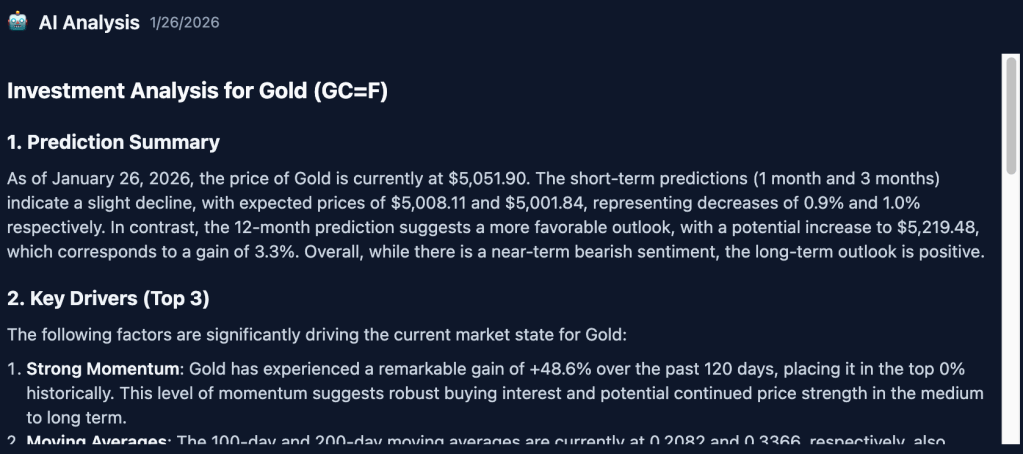

- Review AI Analysis – GPT-powered natural language explanations of model predictions, feature importance, and market context in English or Korean

- Track Sectors – Dedicated sector analysis page with the same rich visualization and forecasting capabilities

The system stores predictions and LLM analyses in Firebase Firestore with merge-based updates, enabling incremental model runs without data loss. Historical price data and current prices are cached efficiently to minimize API calls.

Development Approach – As a solo developer building this project from 0 to 1, I am responsible for every part of the system from data engineering and model optimization to backend APIs and frontend user experience. By incorporating AI-assisted coding techniques throughout development, I’ve been able to:

- Rapidly iterate on model architectures and hyperparameters

- Debug complex data pipeline issues efficiently

- Maintain consistent code quality across Python backend and TypeScript frontend

This approach allows the platform to evolve quickly while establishing a scalable foundation for future enhancements including hedging strategy tools, portfolio optimization, and expanded alternative data sources.

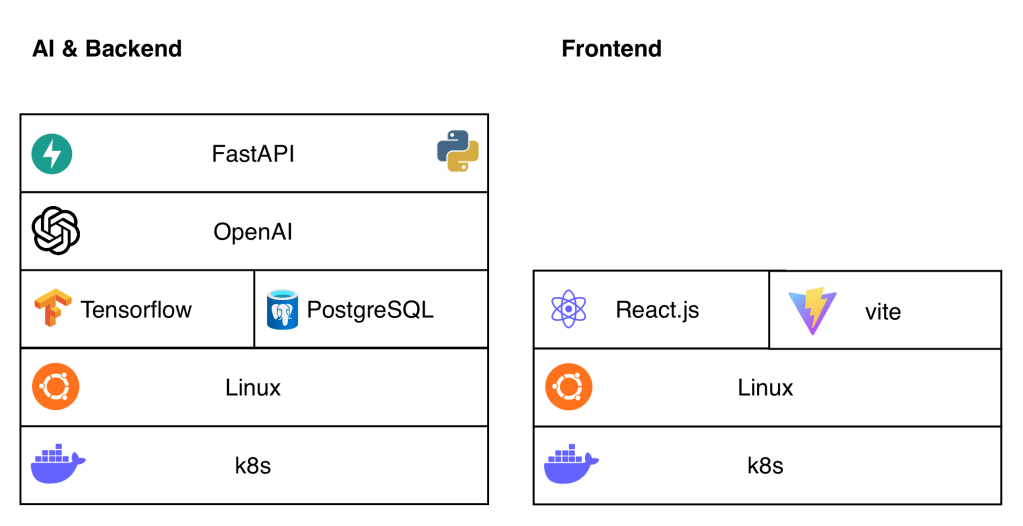

Backend Architecture

Software Stack

Leave a comment